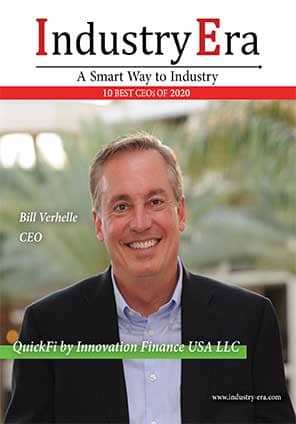

Cyndie Martini

CEO of Member Access Processing

“Delivering Superior Service to Credit Unions”

Member Access Processing (MAP) has defined and built a culture that represents their values. Indeed, they have a decades' long tradition of doing right by their clients every time. The company maintains those high values through regular meetings, rituals, statements, and traditions that re-create and instill a sustainable culture that focuses on a single vision to move the organization successfully into the future.

"Member Access Processing has defined and built a culture that represent their values, which come from a decades-long tradition of doing right by their clients every time. MAP is Visa’s first and only CUSO (Credit Union Service Organization) relationship with the company’s Debit Processing Service."

Cyndie Martini is the CEO of Member Access Processing (MAP). Her primary role is to ensure the growth, profitability, success, service, and long-term viability of the company for its shareholders, clients, members, and staff. Indeed, as she declares, “It is my responsibility to safeguard our future and advance a culture and organization poised and prepared to meet the needs of our board, employees and clients.”

MAP was initially formed as part of the Washington League of Credit Unions to help member institutions bring debit card processing to their members. As Cyndie explains: We were looking for a preferred provider, one that could provide credit unions with advanced technology and systems for portfolio growth that would enhance member services.” Further, she states, “Our decades-long partnership with Visa has allowed us to revolutionize services and solutions for credit unions. Visa sets the standard for payments, providing state-of-the-art tools to empower credit unions to compete and grow.” Today, MAP is recognized for providing fundamentally superior service to credit unions and allowing credit unions to fully serve their members with all Visa and other third-party offers.

MAP is Visa’s first and only CUSO (Credit Union Service Organization) relationship with the Debit Processing Service. In that key role, MAP has helped guide Visa to understand the unique role of credit unions in the payments market. Visa is used to working with larger financial institutions and in one-on-one relationships. “Our clients turn to us when they see trends or disruptions in the market, and we regularly advise them on changes that may impact them,” explains Cyndie. “Today API’s and cloud-based technology are the latest trends that are impacting credit unions. Early on, we chose not to have our own hardware. Instead, we have our clients connect directly to Visa or a third-party provider and thus use Visa systems for processing transactions, fraud, disputes, etc. This arrangement has allowed our clients to align with Visa, allowing them to benefit from functional capabilities and industry-related changes without delays or interruptions.”

For example, one of MAP’s long-time clients, Connection Credit Union (CCU), an institution that serves people who live, work, worship, or go to school in Kitsap County, Washington, was looking to reduce costs and deliver better member service. CCU met with their core data processing partner, ESP, and MAP to discuss the best way to move forward. ESP was more than happy to build a credit card interface for CCU in conjunction with MAP. Scott Prior, CCU’s CEO, has been through a few card conversions in the past, so he was pleased with the outcome. “This conversion was twice as smooth as any other one I have gone through,” he stated. “These are two great vendors to work with because they are always responsive and vested in our ongoing success.”

MAP has always offered “Free Training” for the life of a client’s contract. “We know our clients need to understand how the products and services work fully. We have invested in education and training, so our clients can benefit from the programs and services they use, including marketing, training, and measurement,” said Cyndie. “Success never happens in a vacuum. I consider it a privilege to work with the MAP team and our Board. Their commitment and dedication to providing superior solutions and service truly make a difference in the lives of our client’s credit union members and member businesses.”

Truly, MAP’s values and culture are shaped by the steady hand of their CEO. For company’s like MAP, it is leadership that differentiates their success and the success of their credit union clients. By doing right by their clients every time MAP is not only helping it’s own clients, it is setting the standard for card processing and Credit Union Service Organizations across the country. IE

Company

Management

Cyndie Martini

CEO of Member Access Processing

Description

Member Access Processing is the nation’s only aggregator of the Visa® Debit Processing Service platform for credit unions. MAP’s special role in the marketplace provides our client credit unions the unique opportunity to leverage the Technology, Security, and Service of Visa® for their members. Our commitment to the credit union movement means we value our clients first and foremost.